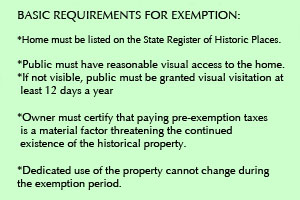

Owners of historic homes in Honolulu and other areas of Oahu are fortunate, not only to own a piece of history, but to be eligible for a real property tax break, as well. The law in City & County of Honolulu (Oahu) currently allows owners of historic homes who apply for a Public Dedicaton Exemption to pay a flat $300 per year in property tax, often saving the homeowners thousands of dollars a year. The law that allowed reduction of the real property tax on these Honolulu historic homes was enacted in the 1980’s, under Mayor Frank Fasi, in an effort to enable owners of Oahu historic homes to have sufficient extra funds to help preserve and maintain the historic homes in the public interest. The public interest of this law is the ability of the public to view and appreciate such homes, memorializing history by providing a record of time, place and use, and to preserve the character and good repair of neighborhoods, protecting property values.

Historic Charles Dickey Designed Home on Oahu

Historic Charles Dickey Designed Home on Oahu

Over the past several years, the Honolulu County historic home Public Dedication tax exemption law has come under attack because of lack of oversight and enforcement of the requirements. The City & County has cited lack of funds and staffing as the main reason for this. A small portion of the homes covered under the exemption had fallen into disrepair and many others could not be seen from the street because of heavy plant growth or fencing on the property.

Particularly, many of the more expensive homes were obstructed from view. The law was also called into question because, in reviewing the names of the owners of all the exempt properties, many seemed to be wealthy individuals, with multiple properties, who probably did not need to tax break to maintain their properties.

In the past few years, there has been greater enforcement of the law’s requirements and some owners have opted out of the program or were deemed ineligible for the exemptions, due to non-compliance with the historic homes requirements. Currently (January 2013) there are 241 Oahu homes on the historic register that are eligible for the historic home tax exemption. A list of these County of Honolulu Historic Homes and how to apply for the exemption follows:

- Oahu Homes Dedicated to the Public on the Tax-Exempt List -

NOTE: Public viewing for obstructed homes is generally the 2d Saturday of each month from 9:00am-4:00pm. - Honolulu Residential Tax Exemption Ordinance -

The text of the law governing the exemption. - Honolulu Residential Tax Exemption Forms -

If you would like to apply for the exemption.

For More Information on Oahu Historic Homes, see:

Hawaii DNLR State Historic Prservation Division

Historic Hawaii Foundation - Historic Hawaii Foundation is a statewide non-profit organization, Historic Hawai‘i Foundation encourages the preservation of historic buildings, sites and communities relating to the history of Hawai‘i.